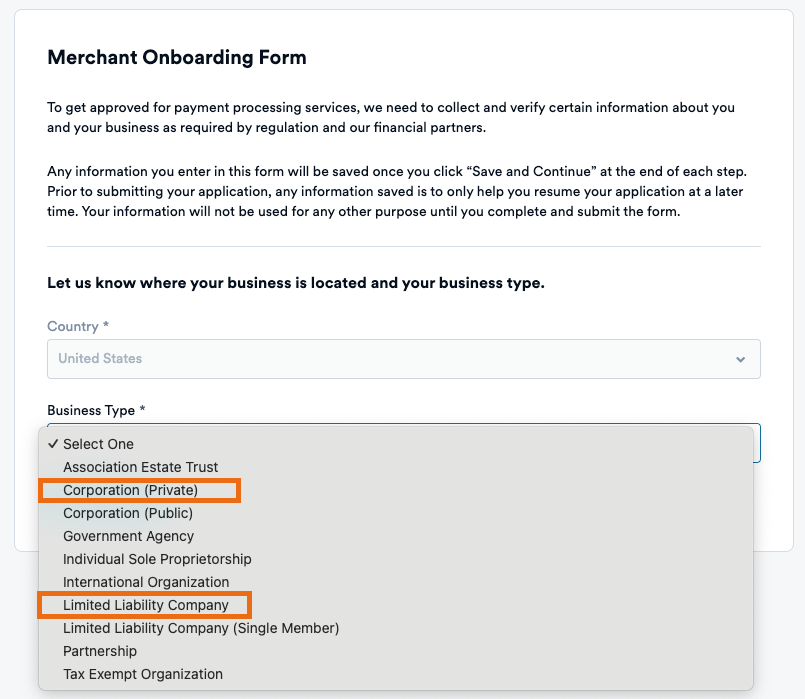

A step-by-step guide to filling out your Business, Owner and Processing Information.

AR Workflow has integrated with Finix to provide you with the ability to accept payments from customers both in the software and via our secure, online payment portal.

Onboarding with Finix is required to continue using AR Workflow's payment features as well as to pay for your AR Workflow Subscription.

The onboarding process for Finix will take about 15 minutes and must be completed by the business owner or an Admin user who has access to the business owner(s) details. Please see below for a list of required information.

Business Information.

-

Date of Incorporation

-

Business Address

-

Tax ID (EIN)

-

Website URL

-

Business Phone Number

Owner Information.

-

Controller (Owner) DOB

-

Owner Social Security Number

-

Owner Email Address

-

Home Address

-

Ownership Percentage

Beneficial Owner Information

A beneficial owner owns 25% or more of the business. We collect each individual’s information (up to a max of 4 beneficial owners) to verify their identity. If the owner owns 100%, there will be no need to fill in the beneficial owner details.

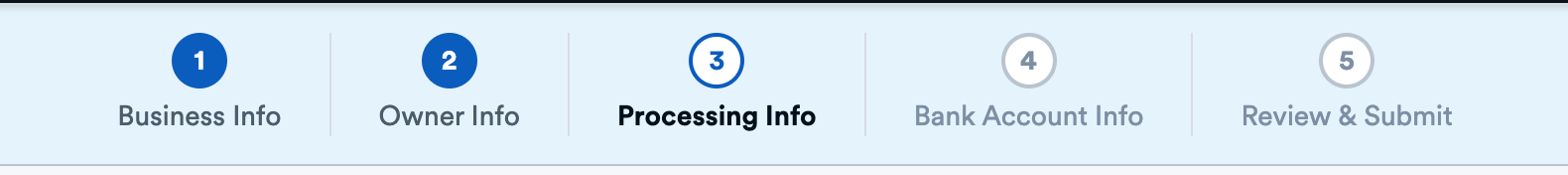

Processing Information.

General Information.

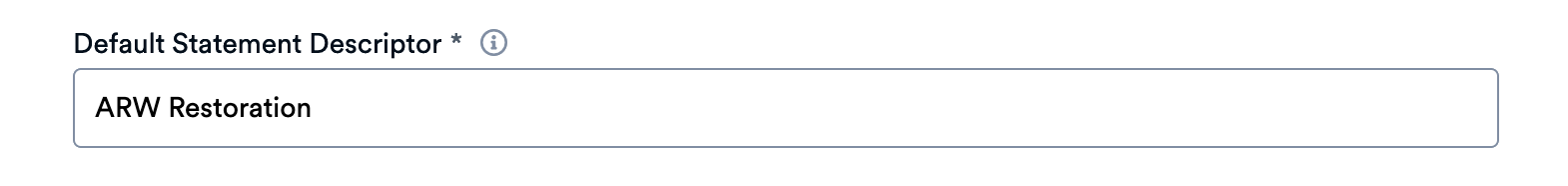

Default Statement Descriptor

This is the text that will show up next to transactions on a customer's bank or credit card statement. Add the business name your customers will be familiar with.

Refund Policy

Set your refund policy to 30 days

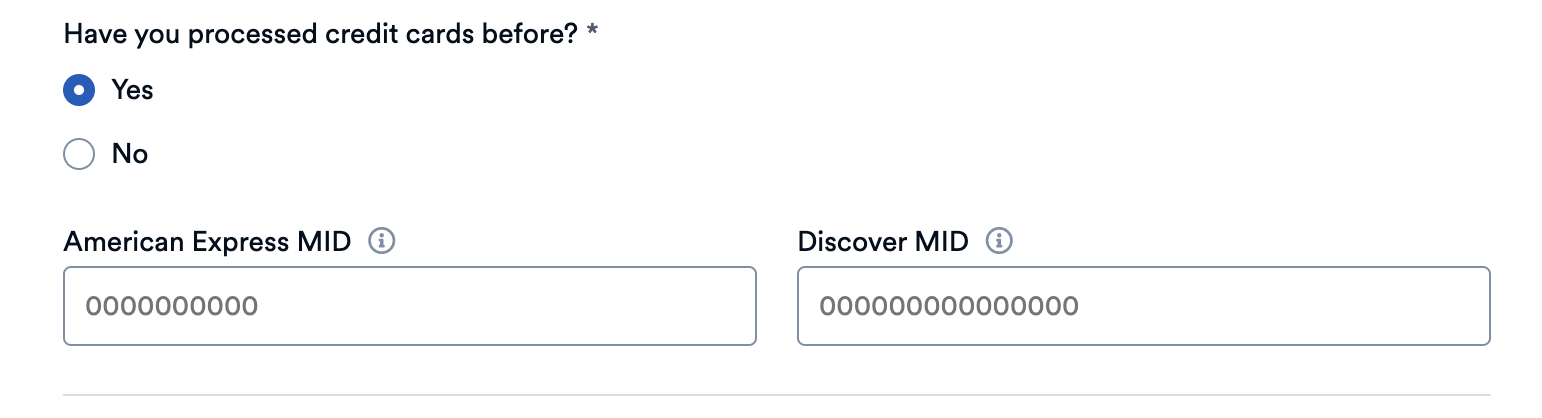

Have you processed Credit Cards before?

Enter YES here. Leave the fields blank for American Express MID and Discover MID. This information is not required.

Merchant fraud is a rising concern in the payments industry. Having a high-level understanding of a merchant's processing volume expectations will help Finix identify any potentially fraudulent/unexpected behavior sooner. (I.e. this merchant only processes $1m/year and runs $500k in their first 2 weeks post onboarding, this is highly questionable behavior).

For this reason, Finix requires every merchant enter their estimated payment volumes during onboarding.

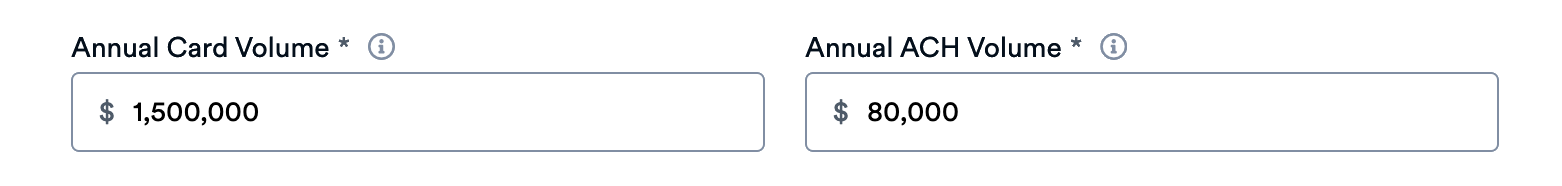

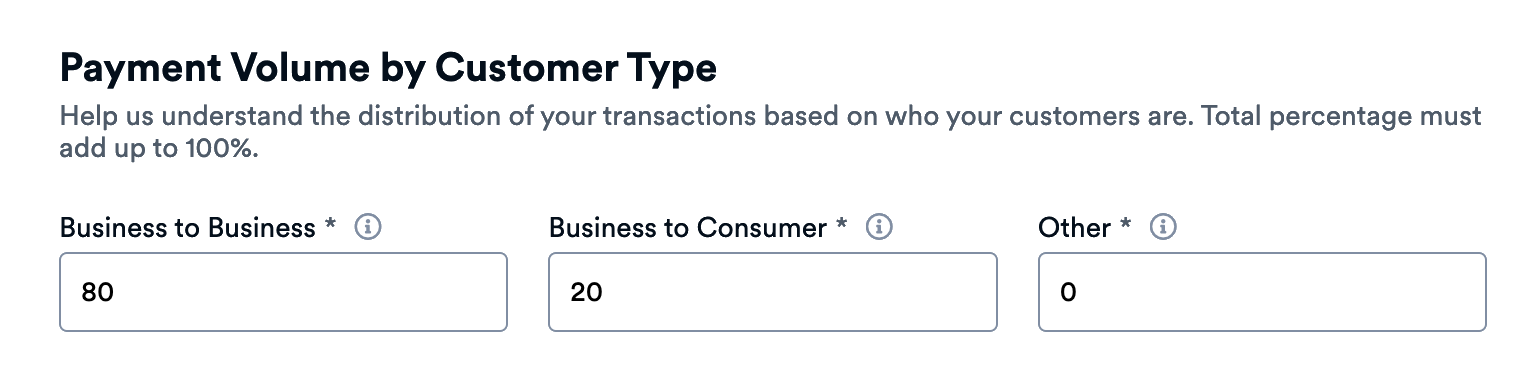

Annual Credit Card and ACH Sales Volume

These numbers do not have to be exact; they are an approximation. On average, businesses using AR Workflow generally see between 1 to 2 million dollars in Credit Cards and 50 to 100 thousand dollars in ACH payments. However, this may differ for your business.

Average Card and ACH Transaction Amount

These numbers do not have to be exact. At AR Workflow, we see an average of around $3,000 per transaction for Credit Card and ACH, however, this number may be higher or lower for your business.

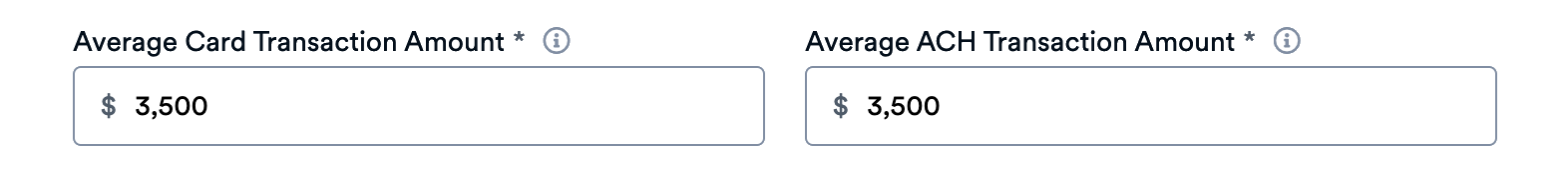

Card Volume

Set your Credit Card Volume to 100% and type in 0 for In-Person and Mail/Telephone.

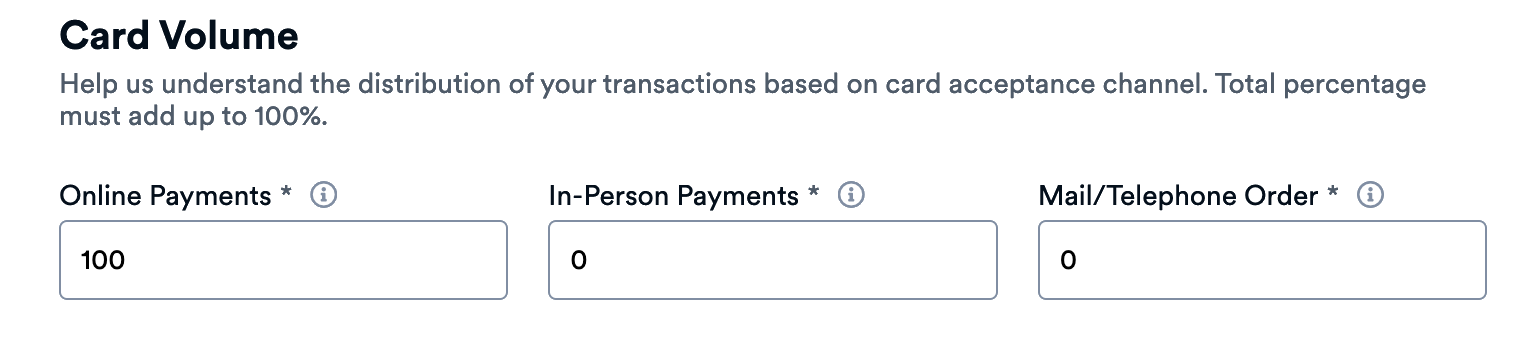

Payment Volume by Customer Type

For Restoration businesses, we generally see about 70-80% B2B payment volume and 20-30% B2C payment volume. These numbers do not need to be exact. Think about how much money you receive from Insurance vs direct from the customer when entering these amounts. Enter 0 for "Other"

Bank Account Information.

-

Account type.

-

Account number.

-

Routing Number.

Once onboarding is complete and you've reviewed and submitted your data, you will be able to begin processing payments with AR Workflow.

If Finix requires any additional information, they will reach out to AR Workflow and we'll let you know.